Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

news.goldseek.com / By David Haggith / 16 February 2016

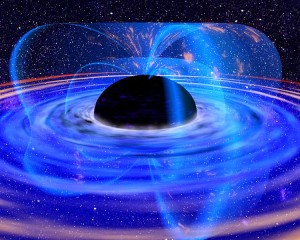

Many nations that experimented with the Fed’s economic recovery plan are now going beyond the outer limits into the twilight zone of negative interest rates. Some of these nations continued to skirt in and out of the edfge of recession throughout their years of economic stimulus; so, now they’ve powered their programs into hyperdrive to see if they can escape the gravity of their circumstances. Their situation appears desperate and hopeless.

Many nations that experimented with the Fed’s economic recovery plan are now going beyond the outer limits into the twilight zone of negative interest rates. Some of these nations continued to skirt in and out of the edfge of recession throughout their years of economic stimulus; so, now they’ve powered their programs into hyperdrive to see if they can escape the gravity of their circumstances. Their situation appears desperate and hopeless.Reality in the alternate universe of zero interest rates and quantitative easing

Immediately after the Fed’s economic acceleration ended in the US, we’ve watched $3 trillion of paper wealth get sucked into a stock market collapse in less than one-and-half months, and that collapse appears to be accelerating to where the Fed is now talking about negative interest rates, too.

In spite of such talk, we are told the US cannot be in recession because recessions typically begin nine months after a bear market breaks out. That premise may be “typically” true, but what is typical about the present situation? Do things work the typical way when you are crashing back down into a recession you never really escaped? Perhaps the Great Recession was the black hole of all recessions. For all of our efforts, we have not escaped it and feel ourselves pulled right back into it now that we’ve exhausted our fuel on futile financial experiments.

Once nations moved into zero interest rates, we entered such a strange new realm of economics that no one in history has ever experienced this kind of an economy. As nations now move past that bound into negative interest rates, can we really know what is “typical” anymore? I think the word “typical” simply doesn’t apply in our present circumstances.

“Trying to divine the end of the rout is difficult given the globe is in the midst of a series of tightly intertwined, self- reinforcing, and correlated trades and narratives (i.e. oil slumps and drags inflation down with it which prompts central banks to ratchet up accommodation which sinks banks which crushes general market sentiment and the overall price declines tighten financial market conditions and scares corporate execs and actual economic activity begins to deteriorate),” conclude [JP Morgan] traders. (Bloomberg)

Seven years of zero-interest targeting by central banks means we have entered an alternate universe where market dynamics are different to such a degree that economic nature is no longer what we are used to: True price discovery of the right cost for credit vanished long ago. True price discovery in the asset market ceased to exist because prices may rise to virtual infinity when trillions of dollars are practically free. Risk ceases to matter when money is practically free in any amount necessary to accelerate the economy … so long as you’re a preferred customer of the Federal Reserve (but not for anyone else).

The post Inside the Black Hole of Negative Interest Rates appeared first on Silver For The People.

Thanks to BrotherJohnF