oftwominds

charles hugh smith

March 8, 2012

Like the bubonic plague, financialization has a lifecycle that cannot be reversed by Federal Reserve or European Central Bank intervention.

Let’s pretend the Federal Reserve can force the financialization lifecycle back into expansion. Why do we need to pretend this can happen? Because the entire U.S. economy and its expansionist Central State now depends on ever-expanding financialization for its survival.

Financialization is like the bubonic plague–it constantly needs new victims as it kills off its existing hosts. Housing? Dead, killed by financialization, aided, abetted and powered by the Federal Reserve. Now the Fed wants to “save” what it already killed via financialization–housing–by buying $1 trillion in plague-infested mortgages and brute-force efforts to keep interest rates below inflation, i.e. negative rates.

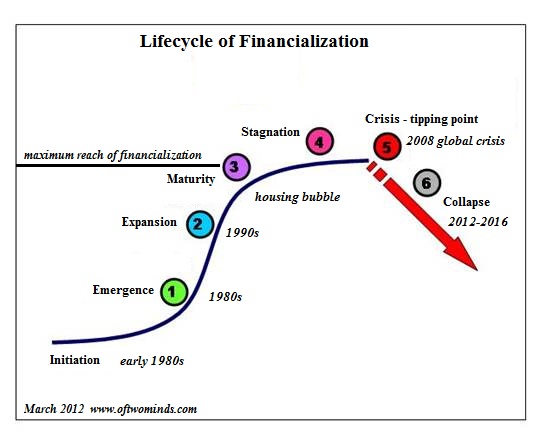

Interestingly, plague, financialization and the power of the Fed all follow the same curve of emergence, expanion, maturity, stagnation and collapse. Natural systems follow S-curves, as described in this seminal paper: A Simple Model for Complex Systems.

What is financialization? Simply put, it is finance infecting and hollowing out all levels of an economy by incentivizing leverage, debt, opacity, speculation, financial fraud, collusion and the perfection of crony capitalism, i.e. financial Elites’ ownership of the government’s regulatory and legislative bodies. Here is another less pungent description via Wikipedia:“Financial leverage overrides capital (equity) and financial markets dominate traditional industrial economy and agricultural economics.”

Here is a chart of the financialization lifecycle. Just as the plague reaches a point of maximum infection, levels off and then eventually disappears into protected pockets, financialization reached its maximum penetration in the housing bubble.

READ MORE